Introduction

Tesla Stock Split, the innovative electric vehicle (EV) company, has garnered significant attention for its groundbreaking technology and its unique financial moves, such as stock splits. In this article, we will delve into what a stock split is, why companies like Tesla choose to split their stocks, the history of Tesla’s stock splits, and the implications for shareholders. We will also explore how investors can trade Tesla stock after a split and discuss the potential risks and benefits of investing in Tesla Stock Split.

What Is a Stock Split?

A stock split is a corporate action in which a company divides its existing shares into multiple shares. For example, in a 2-for-1 stock split, each shareholder receives an additional share for each share held, effectively doubling the number of outstanding shares. The price of each share is adjusted accordingly to maintain the company’s market capitalization.

Why Do Companies Split Stocks?

Companies often split their stocks to make them more affordable and accessible to a broader range of investors. A lower share price can attract more retail investors, increase liquidity in the stock, and improve the stock’s marketability.

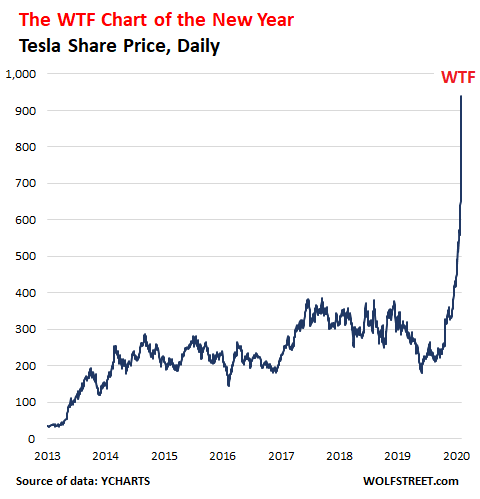

Tesla Stock Split History

Tesla Stock Split has a history of stock splits, with the most recent in August 2020. The company implemented a 5-for-1 stock split, meaning that shareholders received four additional shares for every share held. Before that, Tesla had a 2-for-1 stock split in 2019.

Impact of Tesla Stock Split on Shareholders

Stock splits do not change the overall value of an investor’s holdings, but they can affect investor sentiment and trading behaviour. Some investors may view a stock split as a positive sign and may be more inclined to buy shares, potentially driving up the stock price in the short term.

How to TradeTesla Stock Split Stock After a Split

After a stock split, investors can tradeTesla Stock Split stock in the same way as before. The process for buying and selling shares remains the same, but investors should be aware of any adjustments to the stock price and market capitalization.

Potential Risks and Benefits of Investing in Tesla Stock Split

Investing in Tesla Stock Split offers both risks and benefits. On the one hand, a lower stock price may attract more investors and increase liquidity. On the other hand, the stock price could be more volatile, and there is no guarantee that the stock will continue to rise.

Conclusion

In conclusion, Tesla’s stock splits have been a strategic move to make its shares more accessible to investors. While stock splits do not change the company’s fundamentals, they can impact investor sentiment and trading behaviour. Investors should consider the potential risks and benefits before investing in Tesla Stock Split.

FAQs

- What is the purpose of a stock split?

- A stock split is typically done to make a company’s shares more affordable and accessible to a broader range of investors.

- How does a stock split affect existing shareholders?

- A stock split does not change the overall value of an investor’s holdings, but it can increase the liquidity and marketability of the stock.

- Can a stock split affect the stock price?

- In the short term, a stock split can increase the stock price as more investors may be attracted to the lower share price.

- How often does Tesla split its stock?

- Tesla has had two stock splits in recent years, with the most recent one occurring in August 2020.

- Should I invest in Tesla post-split?

- Investing in Tesla post-split carries both risks and benefits, and investors should carefully consider their investment goals and risk tolerance before investing.

you may also read

Evan Roderick: A Rising Star in Hollywood

MarketWatch Game: A Beginner’s Guide to Virtual Stock Trading