Candlestick patterns are useful tools in technical analysis that traders may use to predict future price movements and assess the mood of the market. A notable example of a pattern with trading implications in futures is the Dark Cloud Cover candlestick pattern. This pattern offers traders information about possible changes in market momentum as well as possibilities for well-timed entry or exit positions. If you are new to investing, consider exploring futures trading for beginners to gain insight into this dynamic aspect of the financial markets. It is distinguished by its bearish reversal signal. The description, creation, interpretation, and practical consequences of the Dark Cloud Cover pattern for futures traders are all covered in detail in this article.

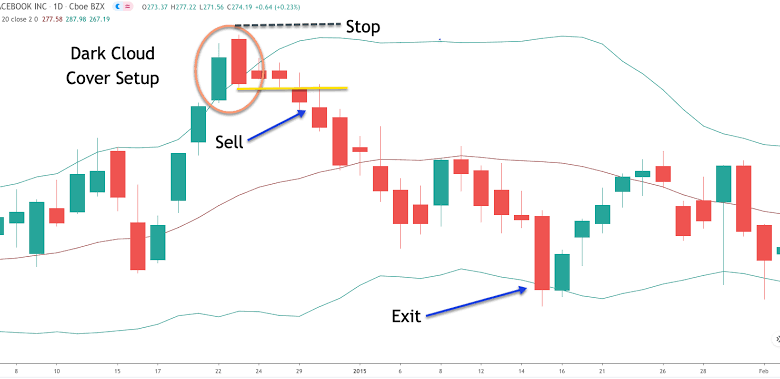

- A possible downward reversal is indicated by the two-candlestick Dark Cloud Cover pattern, which appears at the end of an uptrend. It comprises of a bullish candlestick that begins above the high of the previous day and closes below the middle of the bullish candlestick from the previous day, followed by a bearish candlestick. This formation points to a possible reversal in the current trend as sellers start to apply pressure and drive prices down, indicating that bullish momentum is dwindling.

- Let us examine the Dark Cloud Cover pattern to have a better understanding of how it came to be:

- A bullish candlestick at the start of the pattern signifies rising prices and an overall positive attitude in the market. Usually formed during the previous trading session, this candlestick indicates strength in the uptrend by closing close to its high.

- A gap up opening is suggested by the second candlestick in the pattern, which is bearish and opens above the peak of the bullish candlestick from the day before. But as the trading day goes on, sellers enter the market, pushing prices down and resulting in the candlestick closing below the middle of the bullish candlestick from the day before. Price action is reversing, indicating a change in market sentiment from optimistic to pessimistic.

- Traders frequently view the Dark Cloud Cover pattern as a warning indication of a possible trend reversal and believe it to be a bearish reversal signal. Traders usually interpret the pattern as follows:

- The bearish candlestick falling below the midpoint of the bullish candlestick from the previous day is indicative of a lack of bullish momentum, which is what the Dark Cloud Cover pattern suggests. This might signal a reversal in the upward trend as sellers become more powerful and buyers lose control of the market.

- The bearish candlestick opens with a gap up, but it is unable to cross the high of the bullish candlestick from the previous day, which serves as a resistance level. The pattern’s negative bias is strengthened and the chance of a reversal is increased by this inability to make higher highs.

- To verify the Dark Cloud Cover pattern, traders frequently search for additional confirmation indications. These signals might include a bearish divergence in momentum indicators or a breach below important support level. By evaluating the intensity of the reversal signal, confirmation signals assist traders in making better educated trading decisions.

- Understanding the Dark Cloud Cover pattern can help futures traders make more informed trading decisions in several ways:

- In anticipation of a likely decline in the futures market, traders may utilise the Dark Cloud Cover pattern as a signal to acquire short bets or exit current long holdings. After the pattern is confirmed and a bearish bias is established, entry locations are usually found.

- Stop-loss orders are frequently placed by traders at the peak of the bearish candlestick in the Dark Cloud Cover pattern to properly control risk. This reduces possible losses in the case of a trend reversal and helps guard against unfavourable price changes.

- Profit targets can be established by traders using Fibonacci retracement levels or important support levels to profit from any potential decline that may occur after the Dark Cloud Cover pattern forms. Setting profit goals should take trading objectives and risk-reward ratios into consideration.

- Extra Things Futures Traders Should Think About:

- Trade volume is a crucial factor to consider when spotting the Dark Cloud Cover pattern, as more volume during the bearish candlestick’s creation enhances the reliability of the reversal signal. A notable rise in volume suggests increased selling pressure and supports the pattern’s negative inclination.

- Depending on the analysis time, the Dark Cloud Cover pattern’s efficacy may change. To verify the pattern and evaluate its importance in light of longer-term trends and market dynamics, traders have to think about using a variety of time periods.

- When evaluating the Dark Cloud Cover pattern, traders must take the larger market backdrop into account. The efficacy of the pattern can be affected by variables including economic data releases, geopolitical developments, and general market emotion; these should be considered while making trading decisions.

- Though two candlesticks make up the traditional Dark Cloud Cover design, there are other versions as well, such the “piercing pattern” or the “evening star pattern.” It is advisable for traders to become acquainted with these variances and comprehend how they may affect their trading tactics.

- When trading the Dark Cloud Cover pattern, risk management is crucial, just like it is with any trading method. To reduce risk and safeguard cash, traders should carefully analyse position size, stop-loss placement, and profit-taking tactics.

To sum up, futures traders may use the Dark Cloud Cover candlestick pattern as a useful tool to spot possible trend reversals and make wise trading choices. Through comprehension of the pattern’s creation and interpretation, traders may efficiently manage risk in their futures trading methods, spot entry and exit points, and predict changes in market mood. For newcomers to the world of investing, exploring futures trading for beginners on user-friendly futures trading platforms can provide a solid foundation for understanding market dynamics. The Dark Cloud Cover pattern can improve the profitability of futures trading methods and offers useful insights into market dynamics, but it is not infallible and should be used in conjunction with other technical indicators and risk management tactics.